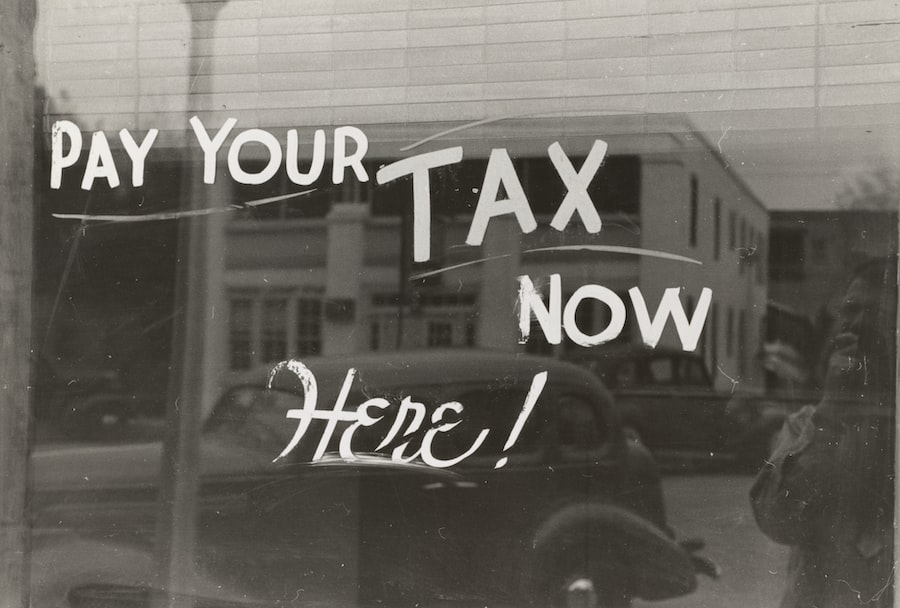

Starting a business can be an exciting and rewarding venture, but it also comes with a myriad of responsibilities and obligations. One area that often causes confusion and stress for startups is tax obligations. Understanding and complying with tax laws is crucial for the success and longevity of any business. In this blog post, we will delve into the importance of understanding your startup’s tax obligations and provide insights into tax obligations for various types of startups in Florida.

The Importance of Understanding Your Startup’s Tax Obligations

Tax obligations are not something to be taken lightly. Failure to comply with tax laws can result in penalties, fines, and even legal issues. It is essential for startups to understand their tax obligations from the very beginning to avoid any potential problems down the line.

Understanding your startup’s tax obligations also allows you to plan and budget accordingly. Taxes can be a significant expense for businesses, and failing to account for them can lead to financial strain. By understanding your tax obligations, you can accurately forecast your expenses and ensure that you have enough funds set aside to meet your tax liabilities.

Tax Obligations for Marketing Solutions Manatee County

If you are starting a marketing solutions startup in Manatee County, Florida, there are several tax obligations that you need to be aware of. One of the primary taxes you will need to consider is sales tax. In Florida, sales tax is imposed on the sale, rental, or lease of goods or services. As a marketing solutions startup, you may be providing services such as advertising or marketing consulting, which are subject to sales tax.

In addition to sales tax, you will also need to consider income tax. Florida does not have a state income tax, but you will still be subject to federal income tax. It is crucial to keep accurate records of your business income and expenses to ensure that you are reporting your income correctly and taking advantage of any deductions or credits that may be available to you.

Tax Obligations for Business Success Pinellas County

For startups in Pinellas County, Florida, the tax obligations may vary depending on the nature of your business. If you are starting a business success startup, which focuses on providing consulting services to help businesses grow and succeed, you will need to consider both sales tax and income tax.

Similar to the marketing solutions startup in Manatee County, you will need to collect and remit sales tax on any taxable services you provide. However, it is essential to note that not all services are subject to sales tax in Florida. Consulting services may be exempt from sales tax if they are considered professional services. It is crucial to consult with a tax professional or review the Florida Department of Revenue’s guidelines to determine if your specific services are subject to sales tax.

In terms of income tax, as mentioned earlier, Florida does not have a state income tax. However, you will still need to report your business income on your federal income tax return. Keeping accurate records of your income and expenses is crucial for accurately reporting your income and taking advantage of any deductions or credits that may be available to you.

Tax Obligations for Z ILLUSTRIOUS Local Marketing

For startups in the local marketing industry in Florida, there are specific tax obligations that need to be considered. Sales tax is one of the primary taxes that local marketing startups need to be aware of. If you are providing advertising or marketing services to clients in Florida, you will generally be required to collect and remit sales tax on those services.

It is important to note that the sales tax rate may vary depending on the county or municipality where your business is located. It is crucial to consult with the Florida Department of Revenue or a tax professional to ensure that you are charging the correct sales tax rate and complying with all relevant regulations.

In terms of income tax, as mentioned earlier, Florida does not have a state income tax. However, you will still need to report your business income on your federal income tax return. Keeping accurate records of your income and expenses is crucial for accurately reporting your income and taking advantage of any deductions or credits that may be available to you.

Tax Obligations for Empower Entrepreneurs Florida

If you are starting an entrepreneurship-focused startup in Florida, there are specific tax obligations that you need to be aware of. Sales tax is one of the primary taxes that you will need to consider. Depending on the nature of your business, you may be providing taxable services or selling tangible goods, both of which may be subject to sales tax.

It is crucial to consult with the Florida Department of Revenue or a tax professional to determine if your specific services or products are subject to sales tax and to ensure that you are charging the correct sales tax rate.

In terms of income tax, as mentioned earlier, Florida does not have a state income tax. However, you will still need to report your business income on your federal income tax return. Keeping accurate records of your income and expenses is crucial for accurately reporting your income and taking advantage of any deductions or credits that may be available to you.

Tax Obligations for Small Business Growth Tampa Bay

For startups focused on small business growth in Tampa Bay, Florida, there are specific tax obligations that need to be considered. Sales tax is one of the primary taxes that small business growth startups need to be aware of. If you are selling tangible goods or taxable services in Florida, you will generally be required to collect and remit sales tax on those sales.

It is important to note that the sales tax rate may vary depending on the county or municipality where your business is located. It is crucial to consult with the Florida Department of Revenue or a tax professional to ensure that you are charging the correct sales tax rate and complying with all relevant regulations.

In terms of income tax, as mentioned earlier, Florida does not have a state income tax. However, you will still need to report your business income on your federal income tax return. Keeping accurate records of your income and expenses is crucial for accurately reporting your income and taking advantage of any deductions or credits that may be available to you.

Common Tax Mistakes Made by Startups

When it comes to tax obligations, startups often make common mistakes that can lead to penalties and legal issues. One of the most common mistakes is failing to keep accurate records. Keeping detailed records of your business income and expenses is crucial for accurately reporting your income and taking advantage of any deductions or credits that may be available to you.

Another common mistake is not filing taxes on time. Missing tax deadlines can result in penalties and interest charges. It is essential to stay organized and keep track of all tax deadlines to ensure that you are filing your taxes on time.

Additionally, startups may overlook certain deductions or credits that they are eligible for. It is important to work with a tax professional who can help you identify and take advantage of any deductions or credits that may be available to you.

Tax Planning Strategies for Startups

Tax planning is an essential aspect of managing your startup’s tax obligations. By implementing effective tax planning strategies, you can minimize your tax liability and maximize your after-tax profits. Here are some tax planning strategies that startups can consider:

1. Take advantage of deductions: Familiarize yourself with the various deductions available to businesses and ensure that you are taking advantage of all applicable deductions. Some common deductions include business expenses, home office deductions, and startup costs.

2. Consider tax credits: Tax credits can provide significant savings for startups. Research and identify any tax credits that your business may be eligible for, such as research and development credits or energy-efficient credits.

3. Structure your business effectively: The way you structure your business can have significant tax implications. Consult with a tax professional to determine the most tax-efficient structure for your startup, whether it be a sole proprietorship, partnership, LLC, or corporation.

4. Keep accurate records: As mentioned earlier, keeping accurate records is crucial for accurately reporting your income and expenses. Implement a system to track all business transactions and maintain organized records.

5. Work with a tax professional: Tax laws can be complex and ever-changing. Working with a tax professional who specializes in working with startups can help ensure that you are complying with all tax laws and taking advantage of any available tax-saving opportunities.

Taking Control of Your Startup’s Tax Obligations

In conclusion, understanding and complying with your startup’s tax obligations is crucial for its success and longevity. Failure to comply with tax laws can result in penalties, fines, and legal issues. By understanding your tax obligations from the beginning and implementing effective tax planning strategies, you can minimize your tax liability and maximize your after-tax profits.

It is important to consult with a tax professional who specializes in working with startups to ensure that you are complying with all tax laws and taking advantage of any available deductions or credits. Taking control of your startup’s tax obligations will not only help you avoid potential problems but also provide peace of mind as you focus on growing and scaling your business.

If you’re a startup owner, it’s crucial to understand your tax obligations. Ignoring or mishandling your taxes can lead to serious consequences for your business. To help you navigate this complex topic, Zillustrious has published an informative article on Startup Tax Obligations. This article provides valuable insights and tips on how to ensure compliance with tax laws while maximizing deductions and credits. It’s a must-read for any entrepreneur looking to stay on top of their financial responsibilities. Check out the article here.

FAQs

What are startup tax obligations?

Startup tax obligations refer to the legal responsibilities of a newly established business to pay taxes to the government. These taxes may include income tax, sales tax, payroll tax, and other taxes depending on the nature of the business.

What is income tax?

Income tax is a tax levied on the income of individuals and businesses. For startups, income tax is usually based on the profits earned by the business.

What is sales tax?

Sales tax is a tax levied on the sale of goods and services. For startups, sales tax is usually collected by the business from customers and remitted to the government.

What is payroll tax?

Payroll tax is a tax levied on the wages and salaries paid by a business to its employees. For startups, payroll tax is usually based on the number of employees and the amount of wages paid.

What are the consequences of not paying taxes?

Not paying taxes can result in penalties, fines, and legal action by the government. It can also damage the reputation of the business and lead to financial difficulties.

How can startups ensure compliance with tax obligations?

Startups can ensure compliance with tax obligations by keeping accurate records of income, expenses, and taxes paid. They can also seek the advice of tax professionals and use tax software to simplify the process.