Understanding business finances is critical for company success and growth. It encompasses knowledge of income, expenses, and cash flow. A clear financial understanding enables informed decision-making that positively impacts the business.

This includes the ability to interpret financial statements such as balance sheets, income statements, and cash flow statements. These documents provide a snapshot of a company’s financial health and help identify areas for improvement or potential risks. Comprehending business finances also involves understanding profit margins, break-even points, and other key financial metrics.

These indicators help gauge business profitability and guide necessary adjustments to improve the bottom line. Additionally, financial understanding includes awareness of tax obligations and compliance with financial regulations. Key components of business finance understanding include:

1.

Reading and interpreting financial statements

2. Analyzing key financial metrics

3. Managing cash flow

4.

Understanding tax obligations and financial regulations

5. Identifying areas for financial improvement

6. Assessing potential financial risks

7.

Making strategic financial decisions

By maintaining a solid grasp of business finances, company leaders can make informed decisions that drive growth and success. This knowledge allows for effective financial planning, risk management, and strategic decision-making to ensure long-term business sustainability and profitability.

Key Takeaways

- Understanding your business finances is crucial for making informed decisions and ensuring long-term success.

- Creating a realistic budget helps you track your expenses, identify areas for improvement, and stay on track with your financial goals.

- Setting financial goals gives you a clear direction and motivation to work towards achieving them.

- Building an emergency fund provides a safety net for unexpected expenses and helps protect your business during tough times.

- Managing debt wisely involves prioritizing high-interest debt, making timely payments, and avoiding unnecessary borrowing.

- Investing for the future can help grow your business and secure your financial stability in the long run.

- Seeking professional financial advice can provide valuable insights and guidance for optimizing your business finances.

Creating a Realistic Budget

Identifying Income and Expenses

To create a realistic budget, start by identifying all sources of income and categorizing your expenses. This includes fixed costs such as rent, utilities, and salaries, as well as variable expenses like marketing, supplies, and maintenance.

Prioritizing Spending

Once you have a clear picture of your income and expenses, it’s important to prioritize your spending based on the needs of your business. This may involve making tough decisions about where to allocate resources and finding ways to cut costs without sacrificing quality.

Building in Flexibility

Additionally, it’s important to build in a buffer for unexpected expenses or emergencies to ensure that your budget remains flexible. This will help you navigate any unexpected challenges that may arise and ensure that your business stays on track financially.

Setting Financial Goals

Setting financial goals is an important part of managing your business finances. These goals provide a clear direction for your business and help you stay focused on achieving long-term success. When setting financial goals, it’s important to make them specific, measurable, achievable, relevant, and time-bound (SMART).

This will help you track your progress and stay motivated to reach your targets. Financial goals can include increasing revenue, reducing expenses, improving cash flow, or expanding into new markets. By setting clear financial goals, you can create a roadmap for achieving success and measure your progress along the way.

Additionally, setting financial goals can help you stay motivated and focused on the long-term success of your business. Setting financial goals is an important part of managing your business finances. These goals provide a clear direction for your business and help you stay focused on achieving long-term success.

When setting financial goals, it’s important to make them specific, measurable, achievable, relevant, and time-bound (SMART). This will help you track your progress and stay motivated to reach your targets. Financial goals can include increasing revenue, reducing expenses, improving cash flow, or expanding into new markets.

By setting clear financial goals, you can create a roadmap for achieving success and measure your progress along the way. Additionally, setting financial goals can help you stay motivated and focused on the long-term success of your business.

Building an Emergency Fund

| Steps to Building an Emergency Fund | Importance |

|---|---|

| Determine the target amount | Helps to set a clear goal |

| Set a monthly savings goal | Ensures consistent progress |

| Open a separate savings account | Prevents easy access to the funds |

| Automate savings deposits | Ensures regular contributions |

| Reassess and adjust as needed | Adapts to changing financial situations |

Building an emergency fund is crucial for protecting your business from unexpected financial challenges. An emergency fund provides a safety net in case of unforeseen expenses or disruptions to your cash flow. It’s important to set aside funds regularly to build up this reserve and ensure that your business can weather any financial storms that may arise.

Having an emergency fund can provide peace of mind and reduce the stress of dealing with unexpected financial challenges. It can also help you avoid taking on debt or making hasty decisions in times of crisis. By building an emergency fund, you can protect the financial stability of your business and ensure that it remains resilient in the face of uncertainty.

Building an emergency fund is crucial for protecting your business from unexpected financial challenges. An emergency fund provides a safety net in case of unforeseen expenses or disruptions to your cash flow. It’s important to set aside funds regularly to build up this reserve and ensure that your business can weather any financial storms that may arise.

Having an emergency fund can provide peace of mind and reduce the stress of dealing with unexpected financial challenges. It can also help you avoid taking on debt or making hasty decisions in times of crisis. By building an emergency fund, you can protect the financial stability of your business and ensure that it remains resilient in the face of uncertainty.

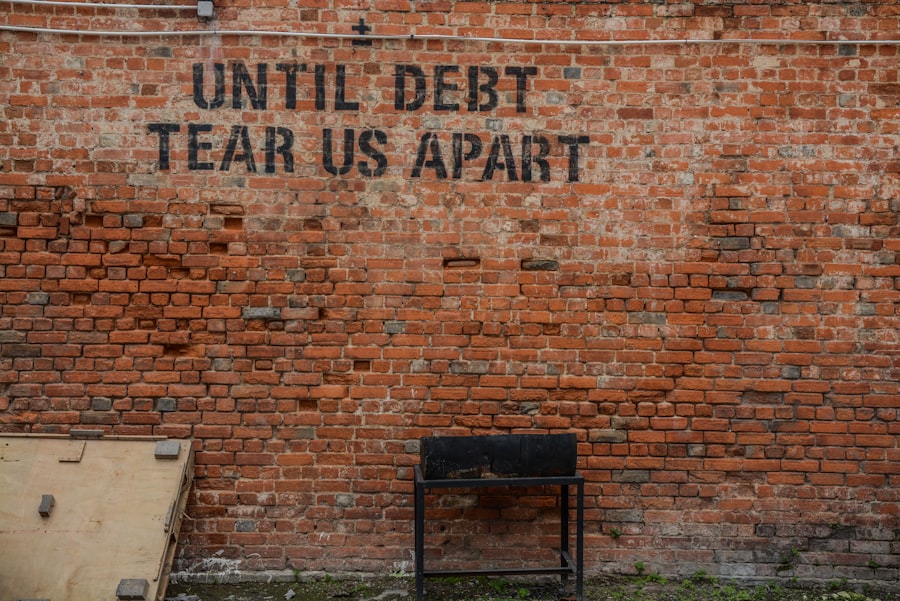

Managing Debt Wisely

Managing debt wisely is essential for maintaining the financial health of your business. While taking on debt can be necessary for growth and expansion, it’s important to do so in a strategic and responsible manner. This includes carefully evaluating the terms of any loans or credit lines and ensuring that they align with the needs and capabilities of your business.

Additionally, it’s important to have a plan for repaying debt in a timely manner to avoid excessive interest charges or negative impacts on your credit rating. By managing debt wisely, you can leverage it as a tool for growth while minimizing the risks associated with excessive borrowing. Managing debt wisely is essential for maintaining the financial health of your business.

While taking on debt can be necessary for growth and expansion, it’s important to do so in a strategic and responsible manner. This includes carefully evaluating the terms of any loans or credit lines and ensuring that they align with the needs and capabilities of your business. Additionally, it’s important to have a plan for repaying debt in a timely manner to avoid excessive interest charges or negative impacts on your credit rating.

By managing debt wisely, you can leverage it as a tool for growth while minimizing the risks associated with excessive borrowing.

Investing for the Future

Evaluating Potential Investments

It’s essential to carefully evaluate potential investments and consider their potential return on investment (ROI) before making any decisions. This helps to ensure that your investments will generate the desired returns and contribute to the growth of your business.

Diversifying Investments

Diversifying investments is critical to minimizing risk and ensuring that your business remains resilient in the face of market fluctuations. By spreading your investments across different assets and industries, you can reduce your exposure to market volatility and protect your business from potential losses.

Achieving Long-term Success

By investing in the future of your business and making informed investment decisions, you can position your business for long-term success and sustainability. This requires a forward-thinking approach, a willingness to take calculated risks, and a commitment to continuous improvement and growth.

Seeking Professional Financial Advice

Seeking professional financial advice is crucial for making informed decisions about managing your business finances. A financial advisor can provide valuable insights and expertise that can help you navigate complex financial challenges and opportunities. They can also provide guidance on tax planning, investment strategies, risk management, and other key areas of financial management.

Additionally, a financial advisor can help you develop a comprehensive financial plan that aligns with the goals and needs of your business. By seeking professional financial advice, you can gain access to valuable expertise that can help you make informed decisions about managing your business finances effectively. Seeking professional financial advice is crucial for making informed decisions about managing your business finances.

A financial advisor can provide valuable insights and expertise that can help you navigate complex financial challenges and opportunities. They can also provide guidance on tax planning, investment strategies, risk management, and other key areas of financial management. Additionally, a financial advisor can help you develop a comprehensive financial plan that aligns with the goals and needs of your business.

By seeking professional financial advice, you can gain access to valuable expertise that can help you make informed decisions about managing your business finances effectively.

If you’re looking for entrepreneurial financial planning advice, you may also be interested in learning about tailored marketing strategies for unique businesses. Check out this article to gain insights on how to effectively market your business to your target audience.

FAQs

What is entrepreneurial financial planning?

Entrepreneurial financial planning involves creating a comprehensive strategy to manage and grow the finances of a business or startup. It includes budgeting, forecasting, investment planning, risk management, and tax planning.

Why is financial planning important for entrepreneurs?

Financial planning is crucial for entrepreneurs as it helps them make informed decisions, manage cash flow, secure funding, and achieve long-term business goals. It also provides a roadmap for navigating financial challenges and opportunities.

What are some key components of entrepreneurial financial planning?

Key components of entrepreneurial financial planning include creating a business budget, setting financial goals, managing debt, establishing an emergency fund, investing in the business, and planning for taxes and retirement.

How can entrepreneurs create a financial plan for their business?

Entrepreneurs can create a financial plan for their business by assessing their current financial situation, setting specific financial goals, creating a budget, monitoring cash flow, investing wisely, and seeking professional financial advice when needed.

What are some common financial mistakes that entrepreneurs should avoid?

Common financial mistakes that entrepreneurs should avoid include mixing personal and business finances, not having a contingency plan, overspending, not saving for taxes, and not seeking professional financial advice.