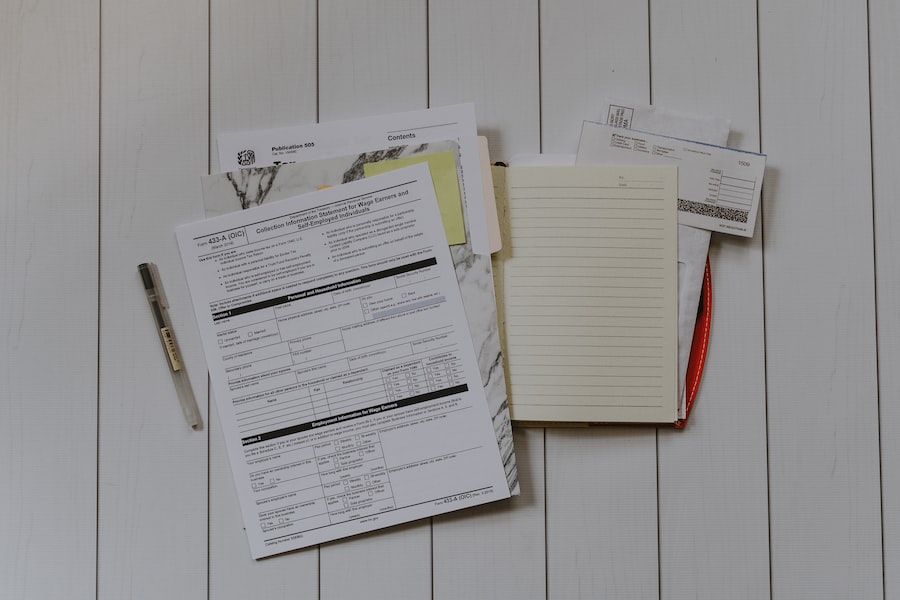

Starting a business can be an exciting and rewarding venture, but it also comes with its fair share of challenges. From developing a business plan to securing funding, there are many steps involved in getting a business off the ground. One often overlooked aspect of starting a business is understanding tax obligations. Taxes can have a significant impact on the financial health of a startup, so it’s crucial for entrepreneurs to have a solid understanding of their tax responsibilities.

Understanding Tax Obligations for Startups

When it comes to taxes, startups may be subject to various types of taxes, including income tax, self-employment tax, and sales tax. Income tax is typically based on the net income of the business and is paid by the owner or owners of the business. Self-employment tax is similar to Social Security and Medicare taxes and is paid by self-employed individuals. Sales tax is collected by businesses on behalf of the state and is typically based on the sale of goods or services.

Federal and state tax laws for small businesses can be complex and ever-changing. It’s important for startups to stay up-to-date on these laws to ensure compliance and avoid penalties. Federal tax laws may include requirements such as obtaining an Employer Identification Number (EIN), filing quarterly estimated taxes, and keeping accurate records. State tax laws vary by jurisdiction but may include requirements such as registering for sales tax, filing annual reports, and paying state income taxes.

Tax Planning Strategies for New Business Owners

Tax planning is an essential part of running a successful business. By implementing effective tax planning strategies, startups can minimize their tax liability and maximize deductions, ultimately saving money in the long run. One common strategy is to take advantage of deductions and credits that are available to small businesses. For example, startups may be eligible for deductions related to business expenses such as rent, utilities, and office supplies.

Another important aspect of tax planning is understanding the timing of income and expenses. By strategically timing when income is received and when expenses are paid, startups can potentially lower their taxable income. For example, deferring income to the following year or accelerating expenses into the current year can help reduce tax liability.

Registering for Federal and State Taxes

Registering for federal and state taxes is a necessary step for startups. To register for federal taxes, businesses must obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This number is used to identify the business for tax purposes and is required for filing tax returns and other tax-related documents.

In addition to federal taxes, startups may also need to register for state taxes. This typically involves obtaining a state tax identification number and registering for sales tax if applicable. The process for registering for state taxes varies by jurisdiction, so it’s important to research the specific requirements for the state in which the business operates.

Tax Deductions and Credits for Small Businesses

There are several common tax deductions and credits that startups can take advantage of to reduce their tax liability. Some of these deductions include:

– Home office deduction: If a portion of the home is used exclusively for business purposes, startups may be able to deduct expenses related to that space, such as rent or mortgage interest.

– Business vehicle deduction: Startups that use a vehicle for business purposes may be eligible to deduct expenses such as gas, maintenance, and insurance.

– Startup costs deduction: Startups can deduct up to $5,000 in startup costs in their first year of operation. These costs may include expenses such as legal fees, marketing expenses, and employee training.

– Research and development (R&D) credit: Startups that engage in qualified research activities may be eligible for a tax credit based on their R&D expenditures.

It’s important for startups to keep detailed records of their expenses in order to claim these deductions and credits accurately.

Keeping Accurate Records and Bookkeeping

Keeping accurate records is crucial for tax purposes. Startups should maintain organized records of all income and expenses, including receipts, invoices, and bank statements. This not only helps with tax compliance but also provides valuable information for tracking the financial health of the business.

Bookkeeping is an essential part of record-keeping for small businesses. It involves recording and organizing financial transactions, such as sales, purchases, and payments. Startups can choose to handle their own bookkeeping or hire a professional bookkeeper or accountant to assist them. Regardless of who handles the bookkeeping, it’s important to establish a system for tracking and organizing financial information.

Sales Tax Compliance for Small Businesses

Sales tax compliance is a critical aspect of running a small business. Startups that sell goods or services are generally required to collect sales tax from their customers and remit it to the state. The specific requirements for sales tax vary by jurisdiction, so it’s important for startups to research the laws in their state.

To stay compliant with sales tax requirements, startups should register for a sales tax permit with the appropriate state agency. They should also keep accurate records of all sales transactions and regularly remit sales tax to the state. It’s important to note that failure to comply with sales tax laws can result in penalties and fines.

Payroll Taxes and Employment Laws

If a startup has employees, it must comply with payroll tax requirements and employment laws. Payroll taxes include federal income tax withholding, Social Security and Medicare taxes, and federal unemployment taxes. Startups are responsible for withholding these taxes from employee wages and remitting them to the appropriate government agencies.

In addition to payroll taxes, startups must also comply with various employment laws, such as minimum wage laws, overtime laws, and anti-discrimination laws. It’s important for startups to familiarize themselves with these laws and ensure that they are following them to avoid legal issues.

Hiring a Tax Professional or Accountant

Navigating the complexities of tax laws can be challenging for startups. That’s why many entrepreneurs choose to hire a tax professional or accountant to assist them with their tax planning and compliance. A tax professional or accountant can provide valuable advice and guidance on minimizing tax liability, maximizing deductions, and staying compliant with tax laws.

When hiring a tax professional or accountant, startups should look for someone with experience working with small businesses in their industry. It’s also important to consider factors such as cost, availability, and communication style. By finding the right professional to assist them with their tax needs, startups can focus on growing their business while ensuring that they are meeting their tax obligations.

Marketing Solutions for Startups in Manatee, Pinellas, and Tampa Bay Counties

In addition to understanding tax obligations, startups also need to develop effective marketing strategies to reach their target audience and build brand awareness. For startups in the Manatee, Pinellas, and Tampa Bay areas, there are several marketing solutions that can help them achieve their goals.

One effective marketing strategy for startups is to utilize social media platforms such as Facebook, Instagram, and Twitter. These platforms allow businesses to connect with their target audience and share content that is relevant and engaging. Startups can also consider partnering with local influencers or bloggers to help promote their products or services.

Another marketing solution for startups is to participate in local events and networking opportunities. This allows businesses to connect with potential customers and build relationships within the community. Startups can also consider offering special promotions or discounts to attract new customers.

Conclusion:

Starting a business is an exciting endeavor, but it’s important for entrepreneurs to understand the various aspects involved, including tax obligations. By understanding the different types of taxes that startups may be subject to and staying up-to-date on federal and state tax laws, entrepreneurs can ensure compliance and avoid penalties. Implementing effective tax planning strategies, keeping accurate records, and hiring a tax professional or accountant can also help startups minimize their tax liability and maximize deductions.

In addition to understanding tax obligations, startups in the Manatee, Pinellas, and Tampa Bay areas should also develop effective marketing strategies to reach their target audience and build brand awareness. By utilizing social media platforms, participating in local events, and offering special promotions, startups can increase their visibility and attract new customers. Seeking professional advice and guidance for tax planning and compliance is crucial for the long-term success of a startup. With the right knowledge and support, entrepreneurs can navigate the complexities of starting a business and set themselves up for success.

If you’re a startup owner looking to navigate the complexities of tax season, you’ll definitely want to check out this related article on navigating financial decisions for startups. It provides valuable insights and strategies for managing your finances effectively, ensuring that you make informed decisions that will benefit your business in the long run. Don’t miss out on this essential resource!

FAQs

What are tax essentials for startups?

Tax essentials for startups refer to the basic tax obligations that a startup business must comply with to avoid penalties and legal issues. These include registering for taxes, filing tax returns, paying taxes, and keeping accurate financial records.

What taxes do startups need to pay?

Startups are required to pay various taxes, including income tax, sales tax, payroll tax, and self-employment tax. The specific taxes that a startup needs to pay depend on the type of business, location, and other factors.

How do startups register for taxes?

Startups can register for taxes by obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). The EIN is a unique identifier that is used to identify the business for tax purposes.

What is the deadline for filing tax returns?

The deadline for filing tax returns varies depending on the type of tax and the business structure. For example, the deadline for filing federal income tax returns for corporations is March 15th, while the deadline for filing federal income tax returns for sole proprietors and partnerships is April 15th.

What are the consequences of not paying taxes?

Failure to pay taxes can result in penalties, interest charges, and legal action. The IRS can impose fines, seize assets, and even shut down the business for non-payment of taxes.

What are some tax-saving strategies for startups?

Startups can save on taxes by taking advantage of tax deductions, credits, and incentives. For example, they can deduct business expenses such as rent, utilities, and office supplies. They can also claim tax credits for research and development, hiring veterans, and investing in certain industries.